Financial Planning, Investments, and Wealth Management.

Modernized for Louisiana.

Your Plan.

Your Money.

Your Future.

Built in Louisiana.

-

You have so many choices of what to do with your money.

With so many people on social media, on TV, and in your network telling you what you should do, we’re here to provide a step-by-step framework that is logical and built on a prudent, repeatable process.

You’re able to confidently invest your money with our system while knowing what accounts, investments, and tax advantages are available to you.

With a forward-looking system like ours, you can project how the decisions you make will impact your future.

No guessing. No gimmicks. No “get rich quick” schemes.

Just smart wealth management, tax planning, and long-term investing strategies that run while you live your life.

Ready to get your plan in motion?

Connect with us today and we’ll reach back out to you ASAP!

-

Play the long game when it comes to building wealth over your lifetime with TFG.

That means getting a strategy that you can stick to with confidence built on tried-and-true methodologies that minimizes mistakes and regret while maximizing your wealth building potential.

You deserve a modern, evidence-based investment strategy and technologies that compound quietly and tax efficiently while you live your life.

Ready to get your strategy in motion?

Let’s build your long game.

-

You don’t build wealth by guessing at deductions once a year. You build it by running a year-round tax strategy that fits your life.

We plan in advance for you, using tools like direct indexing and tax-loss harvesting to offset gains and keep more of your returns working.

Setting up an LLC, S. Corp, or Solo 401(k) are just some of the ways you’re able to better plan for taxes.

Also, we’re happy to work with your CPA to find opportunities to increase your deductions.

So let’s build a tax strategy that helps you keep more of what you earn - starting today!

-

Growing your after-tax net worth is huge, and you should keep more of it.

How do we help you do this?

By reducing expenses, underperformance, and taxes that erode the compounding of your net worth.

Toce Financial Group delivers modern wealth management that turns growth into durability: plan-first portfolios, tax-aware investing, smart cash management, insurance and risk review, and coordinated estate and legacy planning.

The result is a simple, modern, tech-enabled system that compounds now and transfers cleanly later.

Ready to protect what you’re building and pass it on with confidence?

Start your wealth management journey today by clicking here!

Future You

Will Thank You

-

Simplified Onboarding

It’s unbelievably easy to get started investing in your future because we make setup a breeze.

-

Personalized Planning

Your strategic financial plan comes first, then we put together a portfolio built around your goals.

-

No Commissions or Bloated Fees

You know exactly what you’re paying for because we’re completely transparent about our fees.

-

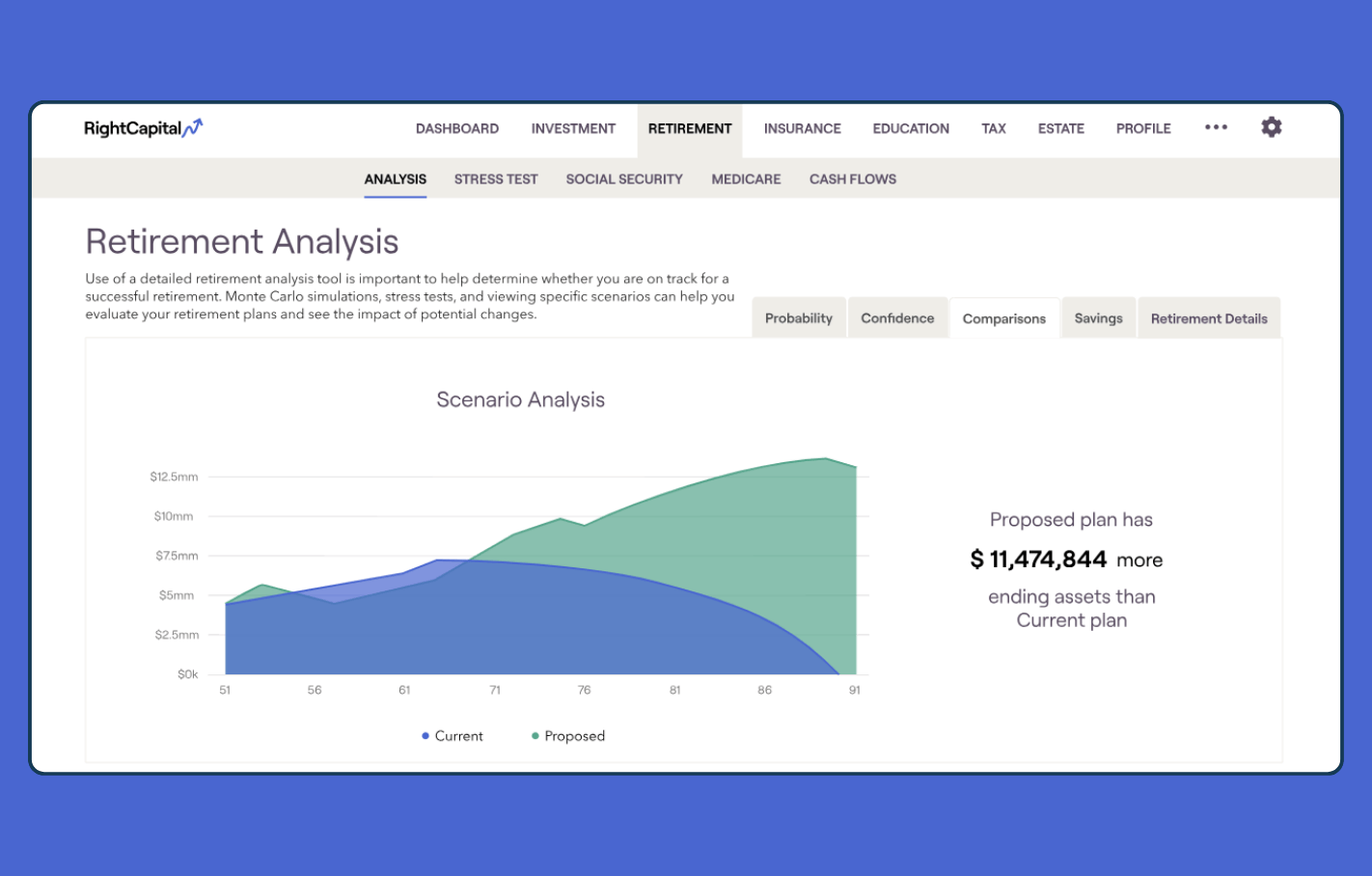

Tech You Understand

You get access to a stack of easy-to-understand financial technology that creates unparalleled efficiency.

Carefully selected to help you achieve superior results

One-of-a-kind, modern, powerful technology only accessible via fee-only RIAs like Toce Financial Group.

Cutting the bloat of fees and commissions while offering tools that would normally have significant costs, accessible to you.

Financial planning technology helps our clients take intentional steps, instead of winging it.

This is the hub for looking at financials, including predictions, scenarios, and projections.

Discover the Power of Compound Interest

Our Firm’s use of Google reviews complies with the SEC Marketing Rule (Rule 206(4)-1). When we display any Google review or star rating in Firm advertisements (e.g., website, social media, decks), we provide clear, prominent disclosures identifying whether the reviewer is a client, whether any compensation was provided, and any material conflicts. For star ratings, we also disclose the rating date, time period covered, that Google is the ratings provider, and whether any compensation was provided in connection with obtaining or using the rating. We present reviews in a fair and balanced manner by avoiding cherry‑picking, including contextual information such as the total number of reviews and average rating, and linking to the full, unedited set of reviews on Google.

We do not provide compensation for reviews. Our Form ADV reflects our use of testimonials/third‑party ratings. We maintain books and records evidencing disclosures, timing, and our reasonable basis for compliance. These controls align with the SEC’s staff guidance and Risk Alerts emphasizing disclosures, oversight, and third‑party ratings practices. (sec.gov)